Turbo Danger Blog

Financial Privacy and Arbitration Opt Outs

Disclaimer: I am not a lawyer and this is not legal advice. This post represents my understanding of the topic as relevant to financial accounts in the United States.

I’m someone who likes to maintain my privacy and rights. Whenever I sign up for a bank account or credit card, I skim the agreements and try to find the arbitration clauses to opt out of giving up my ability to battle out a dispute in court and privacy notices to opt out of the sharing of my personal info.

What is Arbitration?

According to the American Arbitration Association, arbitration is the resolution of a dispute by a third party (the arbitrator) that occurs outside a court.

The arbitration clauses in many financial agreements force this type of dispute resolution unless one opts out within a short period of time of opening the account. Opting out doesn’t mean one can’t choose to arbitrate with their financial instituion in case of a dispute. It just means neither they nor the financial instituion are required to arbitrate. By opting out of an arbitration clause when one opens a new financial account, they protect their ability to take a matter to court in the future (it probably will never happen, but in my opinion, eliminating the risk is best).

A Barrier to Opting Out of Arbitration

In most cases, financial companies will make you send via snail mail a letter stating your rejection of the arbitration provision. This adds a somewhat significant barrier in my opinion. Not because sending a letter is hard. But, because the general consensus seems to be to send your letter by Certified Mail with Return Receipt so you have proof you actually sent it and it got there. For someone to get all the benefits of this option, you have to present your mailpiece to a post office clerk and, as of the time of writing, pay $7.21:

- Postage: $0.66

- Certified Mail: $4.35

- Return Receipt - emailed: $2.20

(The prices for certified mail and return receipt were found on the USPS website). That is a lot of extra work and the cost is quite high compared to only a Forever stamp.

I feel this is intentional. By making it harder to opt out, financial companies decrease the chances of someone successfully doing so. On the other hand, some companies make taking care of this easier: I’ve seen at least one company (Bread Financial) accept a scanned letter via their online messaging portal. And some banks don’t even have arbitration clauses (like Capital One).

Financial Privacy

Another thing I look out for when signing up for a financial account is the privacy opt out notice. This notice arises in part due to the Financial Privacy Rule (Title V) of the Gramm-Leach-Bliley Act (GLBA). Basically, before sharing nonpublic personal information with certain entities, banks are required to notify you and provide you a way to opt out (there are of course exceptions).

A side note about the legal intricacies: The Office of the Comptroller of Currency’s Handbook has a PDF with some background on the topic of the GLBA. It states on page 2,

I don’t understand the implications of this as the CFPB states they have supervisory authority of banks with assets over $10 billion. Does that mean that banks with less than $10 billion in assets don’t have to comply? I don’t think that’s the case as I can’t find anything in the GLBA itself that says it only applies to banks with at least $10 billion in assets. It’s confusing to me.

That aside, the main point I’m trying to make is it’s a good idea to pay attention to these notices when you see them and you can normally find them yourself by searching for the “privacy” pages of financial institutions. It might be called a “Consumer Privacy Statement” or “GLBA Privacy Notice.” The CFPB gives a model of what they generally look like.

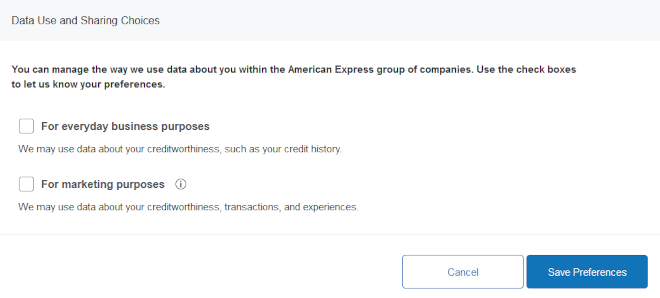

Again, some companies make it easier than others. In my experience, most of the time banks will require you to call a phone number to exercise your ability to opt out. Sometimes it’s automated (in the case of Discover) and sometimes you need to speak with customer service. American Express goes one step further and makes it so you can opt out online! I dislike calling places and when calling to exercise my choices for these, about half the time some sort of confusion arises with the customer service representatives not understanding what I’m asking them to do because I am pretty sure I’m probably one of a few people actually doing this. It honestly surprises me that American Express willingly chose to pay a web developer to implement this functionality online to cater to probably a small group of people who actually want to opt out. But they get a kudos for actually making it super easy (something other companies should do).

A screenshot of American Express’s Data Use and Sharing Choices web form. View the full resolution image (opens in a separate tab).

I hope this post has given you some information how to take advantage of your rights and take charge of your privacy options when opening financial accounts. There is room for improvement for many companies to make opting out of arbitration clauses and sharing of personal information easier.